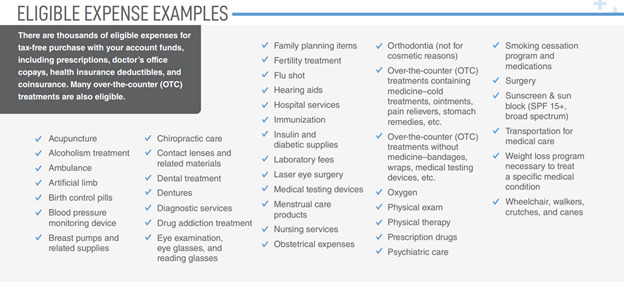

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

What Medical Expenses Qualify as Tax Deductible Under Section 213

2024 COLAs - Health FSA, Qualified Transportation and More

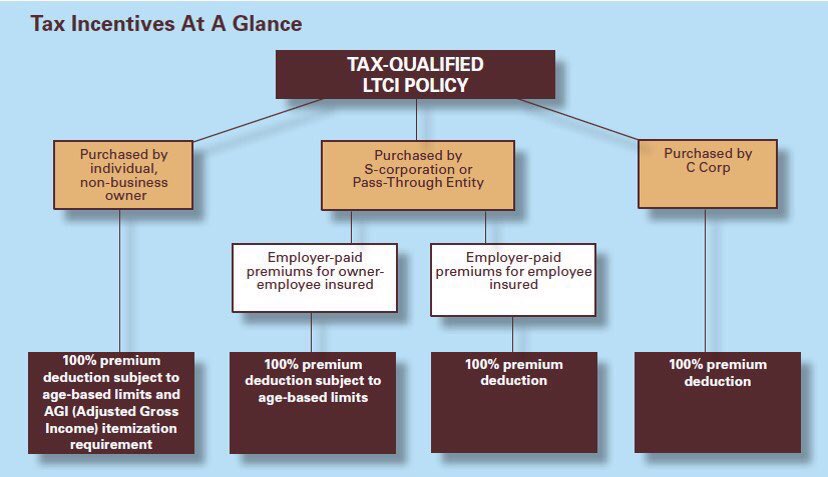

NextGen Long Term Care Planning

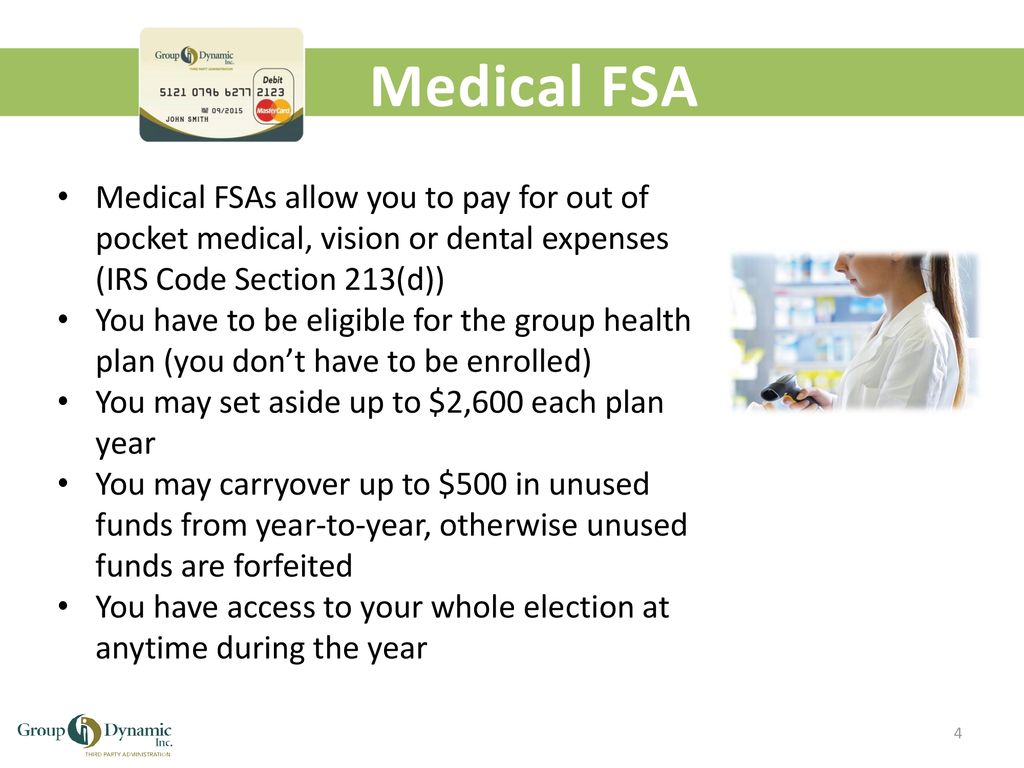

Flexible Spending Accounts - ppt download

2024 COLAs - Health FSA, Qualified Transportation and More

Medical Expenses under IRS Section 213(d) — ComplianceDashboard

Navigating IRS guidance on eligible medical expenses and wellness

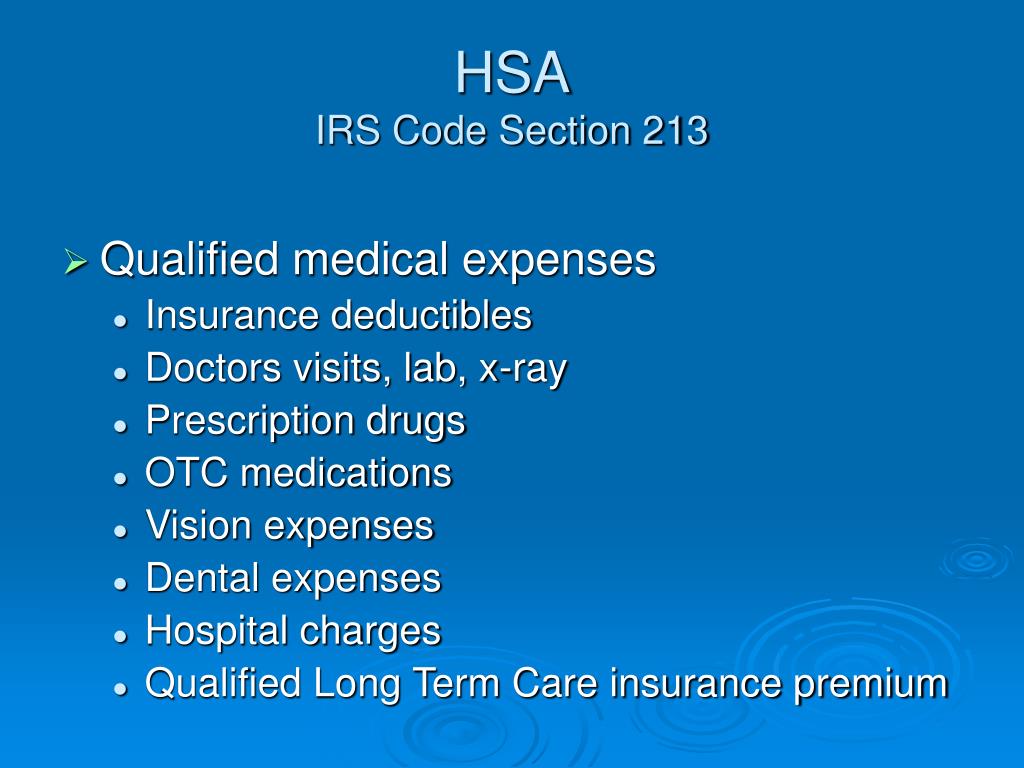

PPT - Consumer Driven Health Plans PowerPoint Presentation, free

Health Savings Accounts: What You Need to Know - Brinson Benefits

fsa-claim-form by Mattress Firm Benefits - Issuu

Internal Revenue Code and Tax Deductible Medical Expenses

Tax-Advantaged Accounts for Health Care Expenses: Side-by-Side

HSA Help Center

FlexPro. State of Indiana. Flexible Benefits Plan. Section 125