Office Supplies and Office Expenses on Your Business Taxes

:max_bytes(150000):strip_icc()/GettyImages-137552576-1--5754396c3df78c9b46367699.jpg)

Office Supplies and Office Expenses on Your Business Taxes

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

How To File And Pay Small Business Taxes

11 Tax Deductions for Small Business Owners

:max_bytes(150000):strip_icc()/sgaExpenses-57d2c13f16bf417c805124f301e13ec4.jpg)

SG&A: Selling, General, and Administrative Expenses

Help entering business expenses

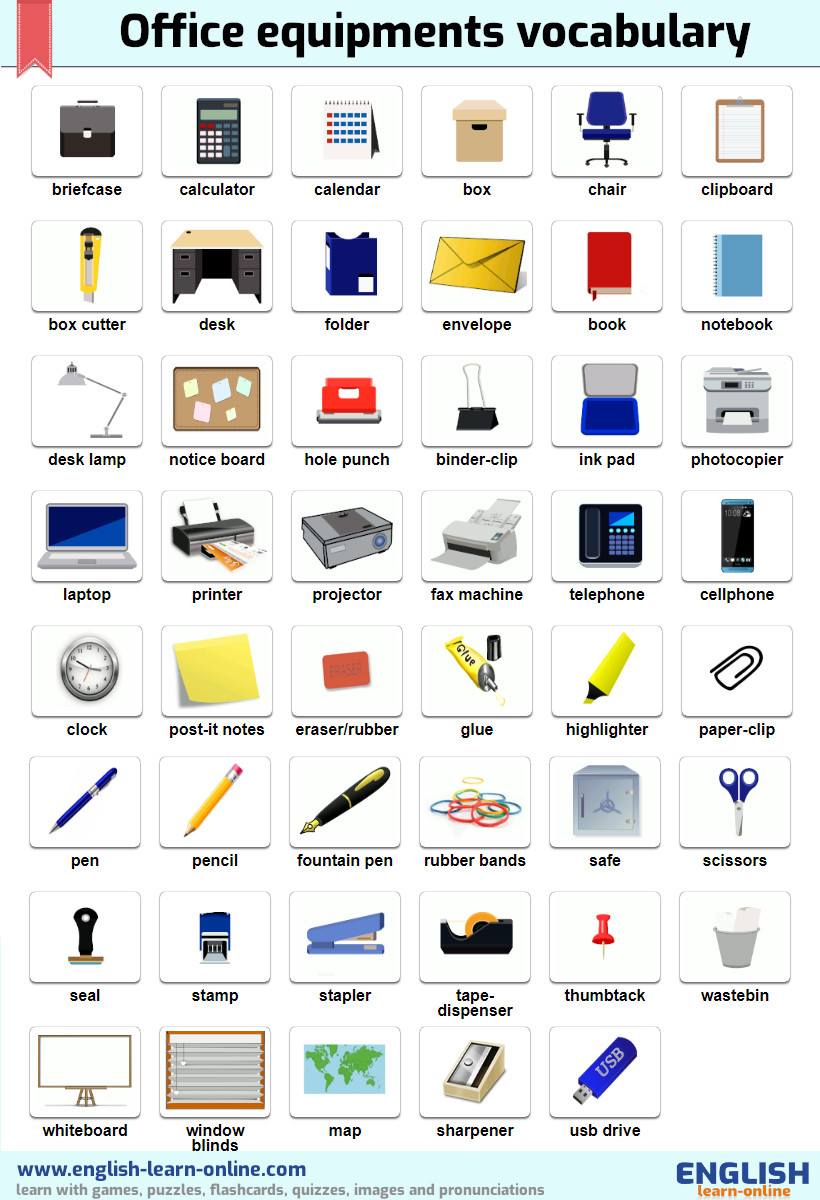

Office expenses vs. supplies: What's the difference? - Quill Blog

How To Write Off Office Supplies On Your Business Taxes

Best Self-Employed Tax Deductions to Know

Home Office Deductions and Expenses: How and What to Claim—Wave Year End

How to maximize your business deductions in the Internal Revenue Code., Kim Spinardi posted on the topic

Home Office Deductions for Psychotherapists

10 Most Common Small Business Tax Deductions (Infographic)

:max_bytes(150000):strip_icc()/small-business-owener-1057253610-61b725a228fa43488f4bf1fcf2272abf.jpg)

Business Equipment vs. Supplies for Tax Deductions

What Is a Tax Deduction? - Ramsey

Are Supplies a Current Asset? How to Classify Office Supplies on Financial Statements

:max_bytes(150000):strip_icc()/a-checklist-for-setting-up-your-home-office-2951767-final-c6bf30917fa54a40a1491b14f845ece6.png)