HSA Planning When Both Spouses Have High-Deductible Health Plans

HSA Planning When Both Spouses Have High-Deductible Health Plans

Financial advisors can help couples navigate the various rules around contributing to and withdrawing from HSA plans when both spouses have high-deductible plans.

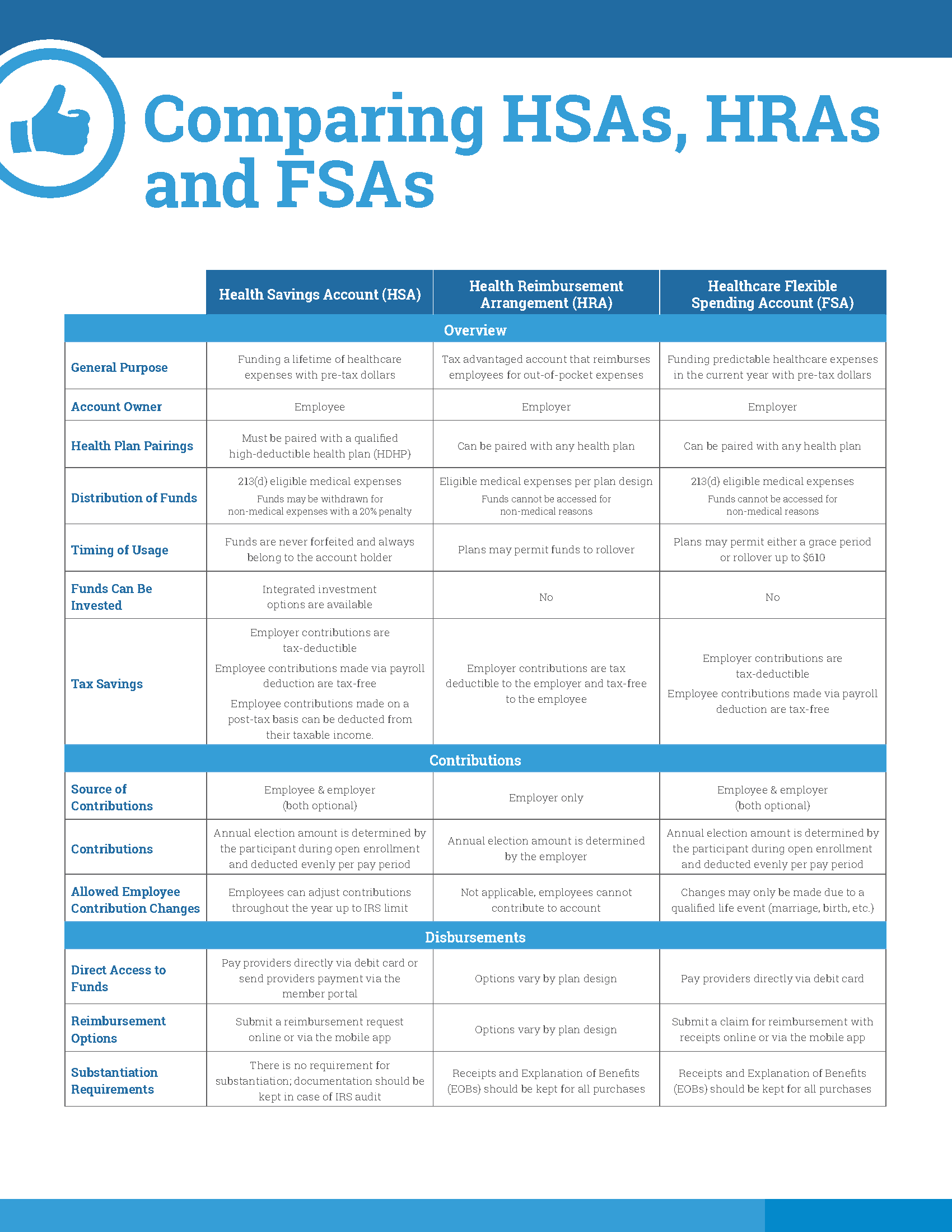

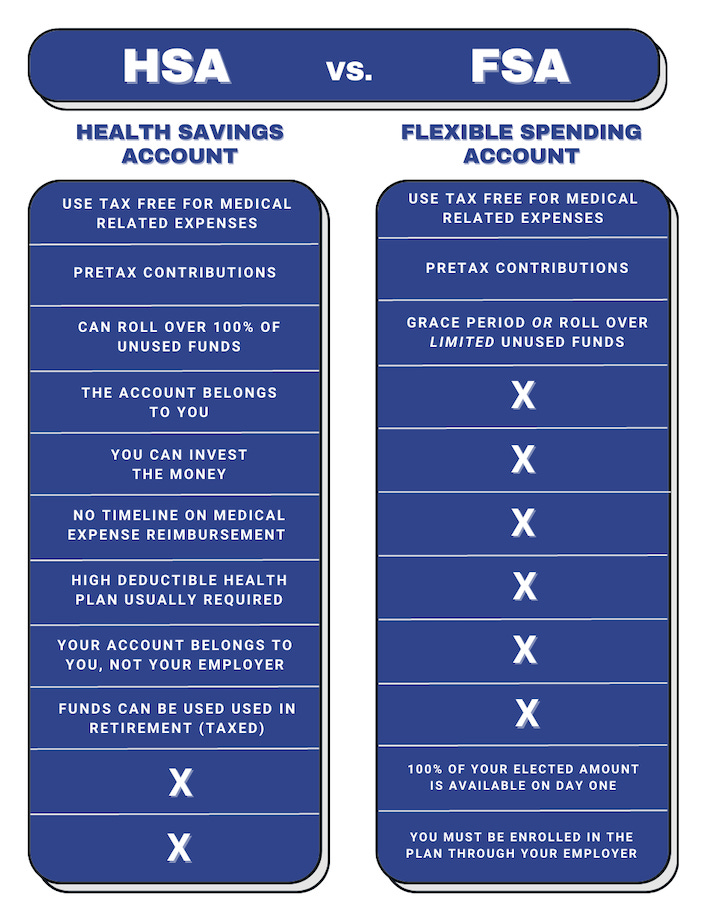

HSA or FSA: Which is Better for Married Couples?

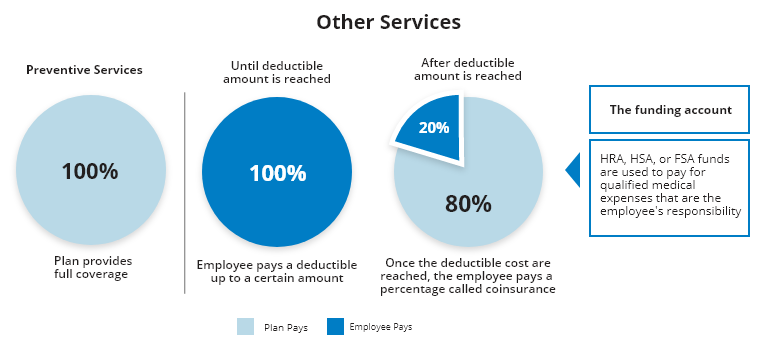

Health Savings Accounts and High Deductible Health Plans

What Is a High-Deductible Health Plan (HDHP)? - Ramsey

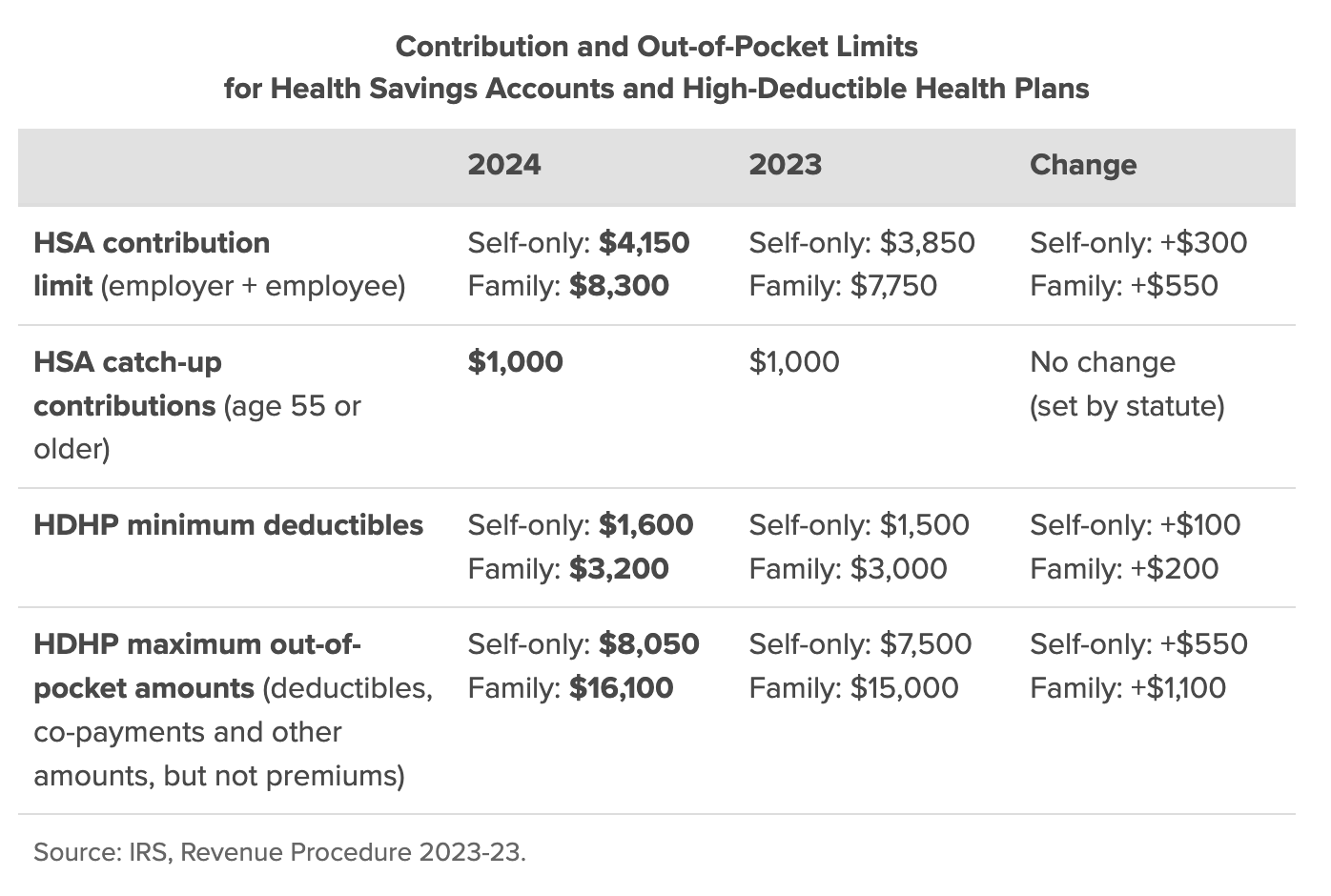

What the New 2022 HSA Limits Means

Section 8: High-Deductible Health Plans with Savings Option

Health Savings Account

High Deductible Health Plan, Employers

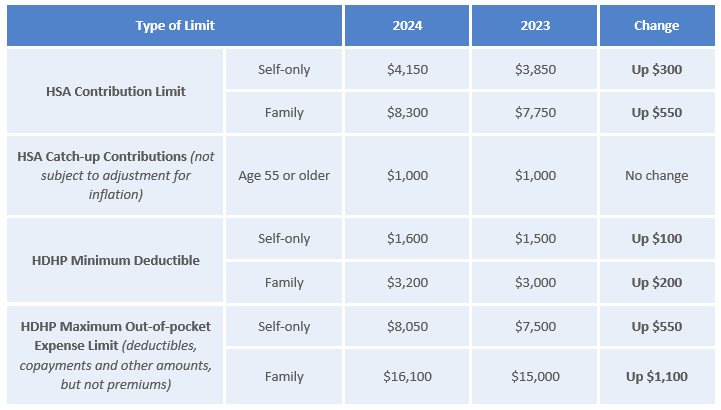

The Basics of Health Savings Accounts (2024)

High deductible health plan cost & savings

2024 HSA Contribution Limits - Claremont Insurance Services

High Deductible Health Plan, Employers

Health Savings Account (HSA) and High Deductible Health Plan (HDHP

Is A High Deductible Health Plan Worth It To Get An FSA?

Section 5: Market Shares of Health Plans - 10240