Self-owned property can be transferred via gift deed

Self-owned property can be transferred via gift deed

Stamp duty would have to be paid on the gift deed prior to its execution, as per the relevant laws of the state where the property is situated and where the gift deed is executed

Chapter 27: GIFT DEEDS (Part 1)

Pennsylvania Gift Deed Forms

What is the process of transferring property through gift deed

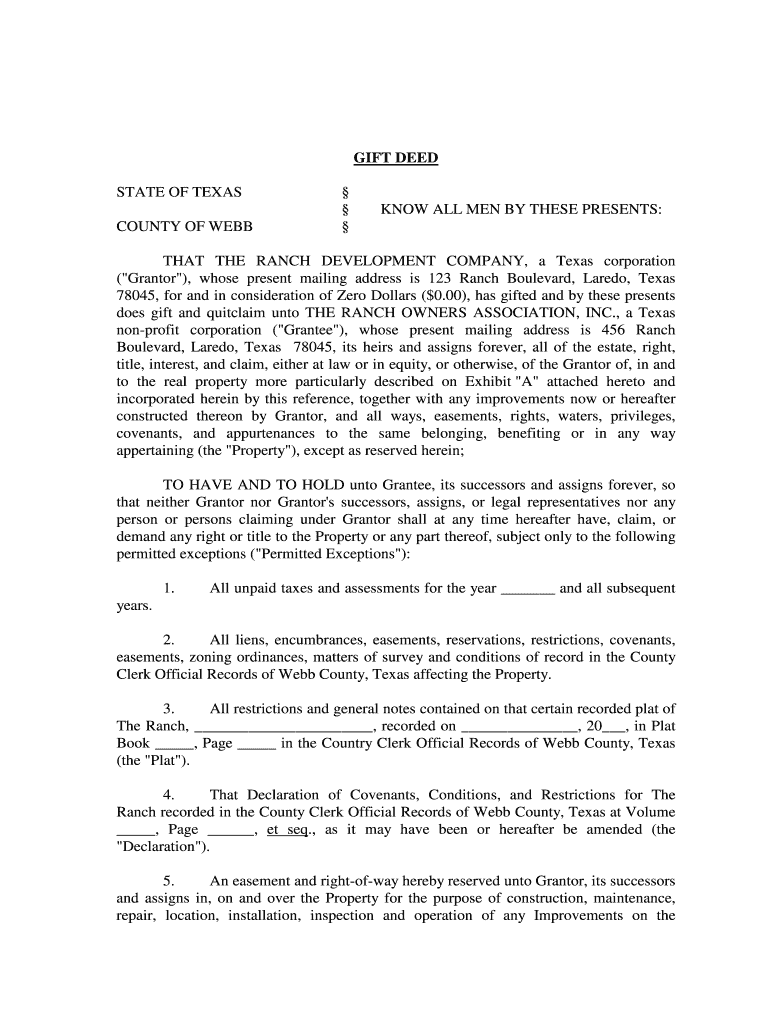

Texas Gift Deed Forms

I signed over my house to my daughter. How do I reverse that

Gift Deed Or Will: What Is the Best Way To Pass On Your Assets To Your

Virginia Gift Deed for Individual to Individual - Deed Of Gift

How to Transfer Property to Your LLC or Corporation

What is the process of transferring property through gift deed

Gift deed texas: Fill out & sign online

Gift Deeds and Gifts of Real Property

What Are the Tax Consequences of Being Added to a Deed?